We've simplified the PACE process

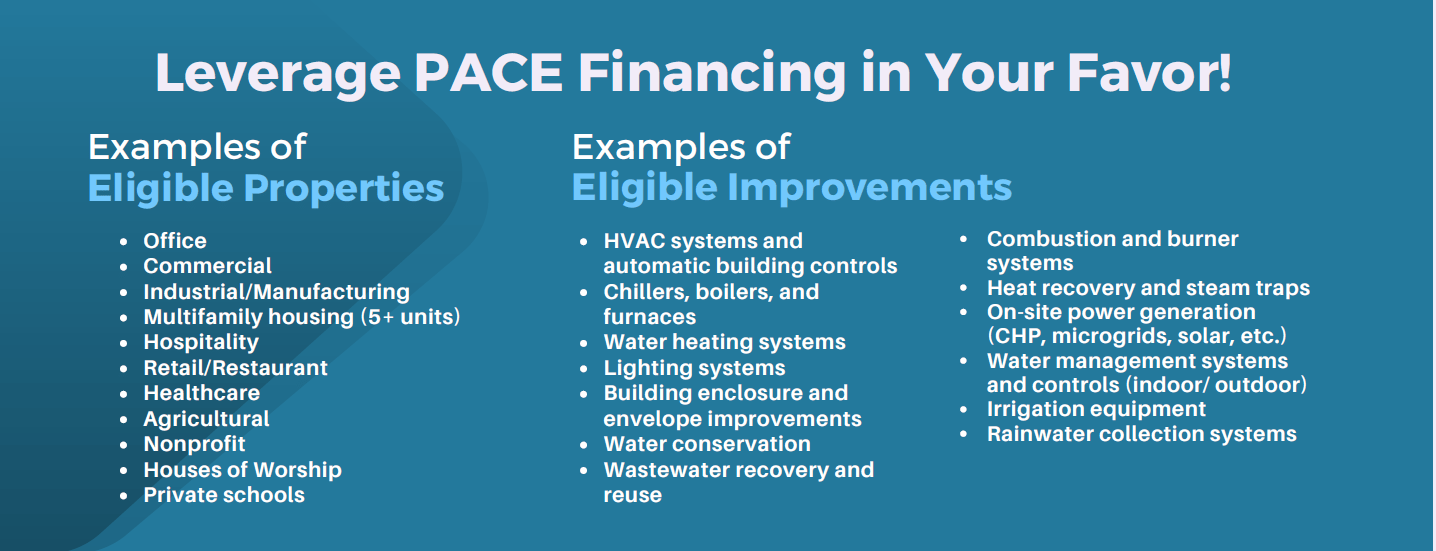

We facilitate the PACE financing process to help property owners obtain low-risk loans for clean energy upgrades on their properties.

Texas PACE Authority streamlines the process of obtaining PACE funding by walking users through every step of the process while protecting property owners through our underwriting process based on "PACE in a Box" best practices.

Step 1: Determine Project Eligibility

Step 2: Determine Project Scope

See TPA Program Guide (page 14)

Complete an (optional) Preliminary Application

Complete an (optional) Energy Audit

Step 3: Select a PACE Lender

Want to be listed as a Capital Provider?

Step 5: Prepare Application

SAMPLE-Required-Documents-Checklist-V2023-03.pdf (texaspaceauthority.org)

Step 6: Obtain Mortgagee Consent (if applicable)

Step 7: Engage ITPR for Project Verification

Step 8: Close on PACE Financing

Step 9: Install Upgrades

Step 10: Verify Installation

Pearl Point Apartments, Rockport (Aransas County)

Project Case Study (English) >>

Building Size: 258,000 square feet

Built: 2019-2020